Financial Reporting Through Risk Lenses

5. 12. 2025 Author: Eva Kostikov On Wednesday, December 3, Metropolitan University Prague experienced an interesting afternoon. The Financial Management and Digital Economy programmes welcomed a guest with first-hand experience from the world of corporate finance – Jaroslav Volmut, Risk Manager at Ernst & Young. His guest lecture “Financial Reporting Through Risk Lenses” offered a behind-the-scenes look at how companies operate in an environment where the accuracy of financial statements is measured not only in numbers, but also in accountability, reputation, and sometimes even the personal risk borne by senior management.Mr. Volmut, who has travelled across most of Europe with EY and regularly works with clients in the United States, brought to MUP not only professional know-how but also concrete practical insights. He focused on how financial reporting is evolving under the pressure of regulatory requirements, technological change, and increasingly complex business models.

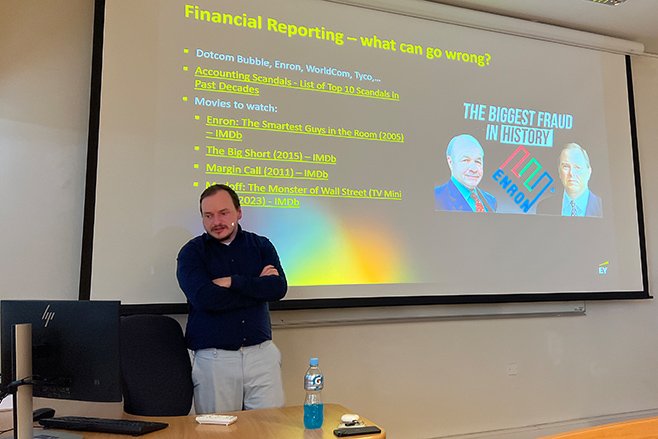

When reporting fails, entire markets shake – history proves it

The introduction highlighted several cases that significantly impacted capital markets: Enron, WorldCom, and Tyco. This was not a mere historical overview. Volmut explained what happened within these companies, how failures in financial reporting can lead to billion-dollar collapses, and why these events laid the foundation for strict regulatory frameworks such as the Sarbanes–Oxley Act.

“Trust, but verify,” he reminded the audience—one of the fundamental principles of modern financial oversight.

From receivables to cybersecurity: risks are everywhere

The lecture also included practical demonstrations of control mechanisms—such as monitoring the ageing of receivables or preventing errors in payment approval processes. Another part of the discussion showed that today’s significant risks arise not only within accounting processes but also within technological infrastructure, ranging from system errors to cyberattacks.

The modern risk manager: analyst, negotiator, and investigator

The lecture demonstrated that contemporary risk management is not solely about identifying issues, but about creating an environment that is resilient, transparent, and sustainable. The session enriched the curriculum of both programmes by offering an opportunity to look into real business situations and showing how theoretical principles are applied in the everyday functioning of large companies.

Other items from the/this section

A new Centre for European Energy Policy and Security

1. 2. 2026 Author: Lukáš Tichý

A new research centre is being established at MUP to complement the Centre for Security Studies and other regionally focused research centres – the Centre for African Studies, the Centre for Middle Eastern Studies and the Centre for Ibero-American Studies. It will operate under the Department of International Relations and European Studies and the leadership of Dr. Lukáš Tichý.

A new Centre for European Energy Policy and Security

1. 2. 2026 Author: Lukáš Tichý

A new research centre is being established at MUP to complement the Centre for Security Studies and other regionally focused research centres – the Centre for African Studies, the Centre for Middle Eastern Studies and the Centre for Ibero-American Studies. It will operate under the Department of International Relations and European Studies and the leadership of Dr. Lukáš Tichý.

ACCA Qualification Opportunities for MUP Students

18. 12. 2025 Author: Irena Jindřichovská

Metropolitan University Prague hosted guest presentations focused on ACCA professional qualification opportunities for students of economics and management programmes. The presentations were delivered by Dr. Pavel Procházka, Business Relationship Manager at the international professional body ACCA (Association of Chartered Certified Accountants).

ACCA Qualification Opportunities for MUP Students

18. 12. 2025 Author: Irena Jindřichovská

Metropolitan University Prague hosted guest presentations focused on ACCA professional qualification opportunities for students of economics and management programmes. The presentations were delivered by Dr. Pavel Procházka, Business Relationship Manager at the international professional body ACCA (Association of Chartered Certified Accountants).

Erasmus Day 2025

17. 12. 2025 Author: Martina Fantová

On Friday, 12 December 2025, the MUP International Office organised the Erasmus Day event to inform interested students about all international opportunities available at MUP.

Erasmus Day 2025

17. 12. 2025 Author: Martina Fantová

On Friday, 12 December 2025, the MUP International Office organised the Erasmus Day event to inform interested students about all international opportunities available at MUP.